Millions of Americans have taken advantage of the USDA home loan program, allowing them to purchase or refinance a home with $0 down at closing. The U.S. Department of Agriculture guarantees these mortgages, so private lenders can offer benefits to rural homebuyers that they typically wouldn't see in conventional mortgage options.

A USDA loan is a mortgage that offers considerable benefits for those wishing to purchase a home in an eligible rural area. USDA home loans are issued through private lenders and are guaranteed by the United States Department of Agriculture (USDA).

The USDA loan’s purpose is to provide affordable homeownership opportunities to low-to-moderate income households to stimulate economic growth in rural and suburban communities throughout the United States.

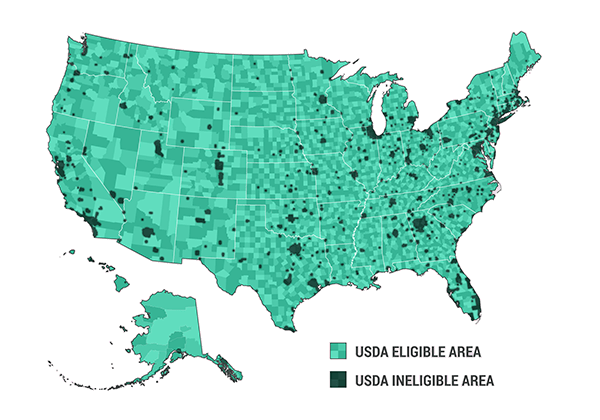

These rural development loans are available in approximately 97% of the nation’s landmass, which includes over 100 million people according to the Housing Assistance Council.

Because of the USDA loan guarantee, lenders are willing to take on more risk and offer eligible homebuyers advantageous rates and terms.

Some of the primary benefits of USDA loans include:

USDA loans open the door to homeownership for many first-time homebuyers who otherwise could not afford a traditional 5-20% down payment. However, the USDA has its own guidelines and requirements, including eligibility requirements for both the homeowner and the property. Lenders will often have their own internal guidelines and requirements in addition to those set by the USDA.

To qualify for a USDA loan, borrowers must meet credit and income criteria set forth by the lender and the USDA. At a minimum, the USDA requires:

While the USDA does not set a minimum credit score requirement, many USDA lenders require at least a 640 score in order to use the USDA’s Guaranteed Underwriting System (GUS).

| Category | Credit Score Range |

|---|---|

| Excellent | 750 and higher |

| Good | 700 - 749 |

| Fair | 650 - 699 |

| Poor | 550 - 649 |

| Bad | 549 and lower |

USDA loans are only available to homebuyers wishing to purchase in what the USDA considers a rural area, although some suburban areas may be eligible as well. The USDA defines a qualified “rural” area as any area with a population under 35,000, is rural in character and has a serious lack of mortgage credit for low- and moderate-income families.

Additionally, USDA loans are only available to homebuyers wishing to purchase a single-family home that will be their primary residence. Homes with acreage may be eligible, if the site size is typical for the area and not used principally for income-producing purposes. Income-producing property and vacation homes do not qualify.

Boundary lines for USDA property eligibility can change every year.

Because USDA loans are meant to assist low-to-moderate income homebuyers, the USDA sets income limits based on the property’s location and household size. The base USDA income limits are:

USDA counts the total annual income of every adult member in a household towards the USDA income limit, regardless if they are a part of the loan.

But it’s also not as simple as looking at your annual pay. USDA ultimately looks at what it calls adjusted annual income, which takes into account acceptable deductions for things like child care, medical expenses and more.

USDA loans typically offer some of the lowest interest rates on the market.

Interest rates on USDA loans are determined by several contributing factors, however the primary factor is your credit profile, as is the case with all mortgage options. Those with higher credit scores often receive the most competitive rates, although borrowers with less than stellar credit may still qualify for a low rate due to the USDA guarantee.

The USDA does not set interest rates. Lenders are free to set their own, and rate quotes can vary based on a host of factors.

Going through the USDA loan process can be different for each homebuyer; however, the typical flow is as follows:

The USDA offers three refinancing options for borrowers looking to lower their rate:

Refinancing a USDA loan can help borrowers lower their monthly mortgage payment by taking advantage of the market’s current interest rates but may result in higher finance charges over the life of the loan. Learn more about each USDA refinance option here to see if a USDA refinance is right for you.

The USDA offers two different loan options to help rural families achieve the dream of homeownership: the USDA Guaranteed Loan and the USDA Direct Loan.

The primary difference in the two programs is who funds the loan. With the guaranteed loan, a USDA-approved lender issues the loan. However, with the direct loan, the USDA issues the loan and provides payment assistance in the form of a subsidy.

While the purpose of both loan programs is to boost homeownership in rural areas, the two programs have significant differences and are meant for two very different financial situations.

For example, with the USDA direct loan, the homebuyer must:

See more differences between the USDA guaranteed and direct loans here.

The first step in applying for a USDA loan is finding a USDA lender. USDAloans.com specializes in connecting you with USDA-approved home loan specialists that are licensed in your state.

Get paired with a USDA lender here.

Once you are working with a lender, expect a conversation that typically includes detailing the home location, desired loan amount, gross monthly income, assets and monthly debts. Lenders will also ask to conduct a hard credit inquiry to get a look at your mortgage credit scores. Credit score minimums can vary by lender and other factors, but a 640 FICO score is a common one for USDA lending.

If your lender determines you may be eligible for a USDA loan, the next step is to provide documentation outlined in the conversation. This includes documents like:

Keep in contact with your loan officer throughout the USDA loan process, as they may need additional documentation along the way.